I just came across an interesting article about Straker Translations, a large and well-known translation company. And I was surprised to read that Straker is losing money. Having owned a small translation business over the last years, I am wondering how a translation company can lose money year over year and still remain in business. A tech startup I can understand. A pharmaceutical company with a new drug I can also understand. These kinds of businesses are financed by institutional investors, VCs and angel investors who are speculating that the company will strike oil. But a translation company? This is a bread-and-butter business, like a supermarket or a hotel. The upside potential is modest when compared to dream companies with practically unlimited potential for growth. Logic dictates that translation service businesses need to make a profit or else go bankrupt and close its doors. But in the case of Straker, the answer is clear. They have a sugar daddy. Or rather many sugar daddies in the form of its stockholders.

The company currently operates purely off its shareholder funding …

This article got me thinking. Are other publicly-traded translation companies also losing money? Are private translation companies losing money? If they are, who is paying the salaries?

Why do translation companies need cash?

In Bill Gates’ book The Road Ahead, Bill writes that Microsoft was short of cash when he started it. Bill said that he could have asked his Dad for a loan, but that would not be the right thing to do. Because a business should not be dependent on outside money. Relying on outside money is also addictive, because what do you do when you need more money? Ask for more? It can become an infinite loop. Bill made it through the cash shortage, but says that he vowed to stockpile enough cash to get through an entire year of operation with no income whatsoever. Of course that never happened and Microsoft made money like crazy. But his vision about cash management is clear. Microsoft went public shortly afterwards and the rest is history.

Most translation companies do not go to the stock market for cash. But when they do, they intend to use the cash for buying other companies and developing new technology like machine translation and AI-based software.

Publicly-traded translation companies are profitable in their day-to-day operations. Because as I said, translation services is a bread-and-butter business with good profit margins. If a translation company loses money, it is in the broader sense when all of the R&D and M&A activity is factored in.

Should a translation company go public?

Going public means getting a lot of money from an IPO (Initial Public Offering). But it also means a lot of reporting, paperwork and accounting stuff. Most translation companies prefer not to deal with the hassles. If they need money, a translation company can get bank financing or approach a private equity firm. Is getting money from an IPO good for the translation company? It certainly seems like it was good for Straker Translations: they can continue to operate and expand without having to worry about small stuff like making a profit. If the company management are getting high salaries then it sounds like a great deal, at least until the money runs out. And if management makes mistakes in their M&A or development strategies, it is the shareholders that will pay the price.

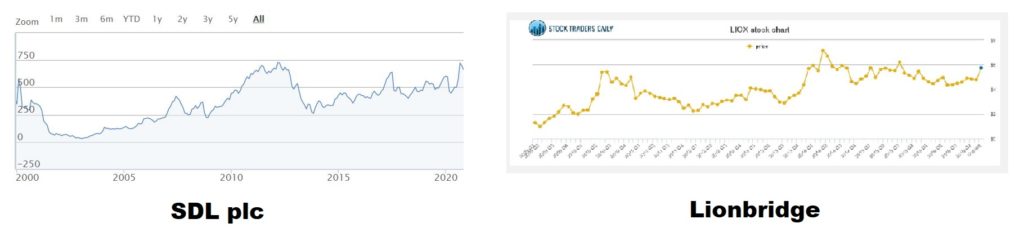

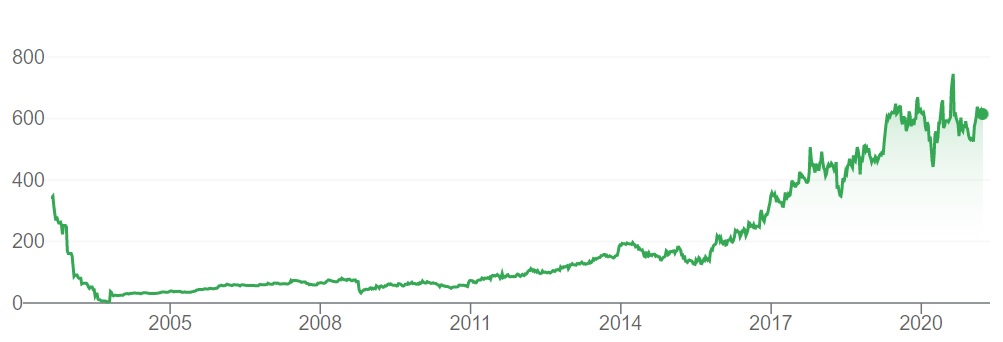

Some translations companies which were once traded publicly did a flip-flop and went private. This includes Lionbridge whose shares were bought by a private equity firm. SDL plc shares stopped trading when it was acquired by RWS last year.

Is owning shares in a translation company good for shareholders?

Looking at the stock charts for SDL and Lionbridge (LSPs which are no longer publicly-traded), it does not look like either of these stocks were chart-breakers. The same can be said about RWS Holdings plc, the company which bought out SDL last year. These stocks returned modest gains and did not seem to outperform the stock market. In the case of RWS, the stock has performed very well over the past 10 years; but an investment in RWS made 20 years ago would have yielded an extremely modest gain. RWS pays a dividend which makes it more attractive to private investors.

It is hard to see the broad appeal such companies have with private investors when compared with widely-held and stocks with high trade volumes. On the other hand, being a publicly traded company provides translation companies with tools that can help them recruit and nurture upper management through stock options and other perks. It also provides them with a war chest for acquisition of other companies. This is true for Straker, who recently bought LSP Lingotek for nearly 10 million dollars.

Bottom Line

The bottom line for me, as a private investor, is not to buy translation company stocks. The returns are not awesome and there is usually no dividend payout. For translation company management, like the founders of Straker, going public and getting stock options can be a bonanza. There are certainly enough translation company millionaires out there who can testify to this.